How Do I File Taxes For Two States

To pay state taxes if youve worked in two or more states youll need to file a non-residential tax return. For example if your total income was 50000 and you earned 30000 in a second state where you moved during the year your apportionment percentage is 30000 divided by 50000 or 60 percent.

Us Tax Filing For Nras Sprintax Blog Tax Resources

You generally use the apportionment percentage in one of two common methods to calculate your state income tax.

How do i file taxes for two states. Wherever you live in the United States federal taxes are the same. Many allow you to file electronically through the state website. Where you happen to live for most of the year is another chief consideration when determining your residency for tax purposes.

How youll file taxes after moving to another state depends on several factors including. While it is still possible to be a resident of another state even if you spent ten months in Texas your presence in Texas for that period of time will be taken as one of the subjective factors in determining how you should file your state taxes. But what if you moved to a different state during the tax year.

Each state taxes the income that was earned in that particular state but most states dont tax the income earned in the other state. On your nonresident tax return for your work state you only list the income that you made in that state. Youll then file a resident state return in the state where you live.

You file the resident form for South Carolina and file the nonresident form for North Carolina. For those who are employed look at your Form W-2 from your employer. This means that you have state tax that needs to.

If you hit a snag or arent sure if youre doing it right it might be worth reaching out to a tax professional who can help you file any state returns required of you to help you avoid potentially. Youll file a nonresident state return in the state you worked. If you and your spouse are filing a joint federal return but you work in or are residents of different states you may need to file separate state returns.

If you have non-work income such as interest income from side hustling etc youll declare that in the state where you live. Filing Part-Year Resident Tax Returns For the year of your move youll file a part-year resident tax return in each state but dont worry you wont have to pay double the state tax. Youd generally divide your income and deductions between the two returns in this case but some states require that you report your entire income on their returns even if you resided there for less than the full year.

How to file state taxes for married couple living in two states when one us just moved. On it list only the income you earned in that state and only the tax you paid to that state. Starting with box 15 you may see a listing of your state state wages state withholding and local income tax if any.

Moving between states or working in two states may however require you to pay income tax to two state governments. Youll also need to file a nonresident tax return if you have non-employment income from a state that is not your home state. State taxes are collected using each states own version of Form W-4.

The general rule of thumb is that you need to file taxes where you earned the money. Youll have to file two part-year state tax returns if you moved across state lines during the tax year. At the end of the year you will file two returns.

Form W-4 is required to pay federal taxes on a percentage of your paycheck. Even if you do have to fill out two sets of tax forms though you dont have to pay tax on the same income twice. For most of us filing a state tax return is just another step in filing a federal return.

In most cases your home state will allow you to claim a tax credit on your resident tax form for the taxes that you paid to your work state. Your tax-filing software just transfers your information to your states return and youre done within minutes. Nonresident New York always do any nonresident returns first Part-year Vermont.

You live in California and you have a rental property in Oregon. One return will go to your former state and one will go to your new state. How you file taxes for the two different states you lived in will depend on several factors including.

That means you need to file a nonresident state return in the state where you worked. Which state is considered the source of the income The specific states involved If you changed jobs or kept the. But you may be able to file multiple state tax returns on your own by visiting each states tax website and filling out each states tax return.

You file the resident form for California and file the nonresident form for Oregon. If I file with a Form W-2 how do I file multiple state returns. Youll want to prepare your returns in this order.

Do you carry the burden of dealing with multiple states on your tax return. Next year assuming nothing changes you and your spouse would jointly file a Vermont resident return along with. Which state is considered the source of the income Specific states involved If you changed jobs or kept the same one If theres a reciprocity agreement between the states involved.

Turbotax Review 2021 Pros And Cons

Your Bullsh T Free Guide To Taxes In Germany

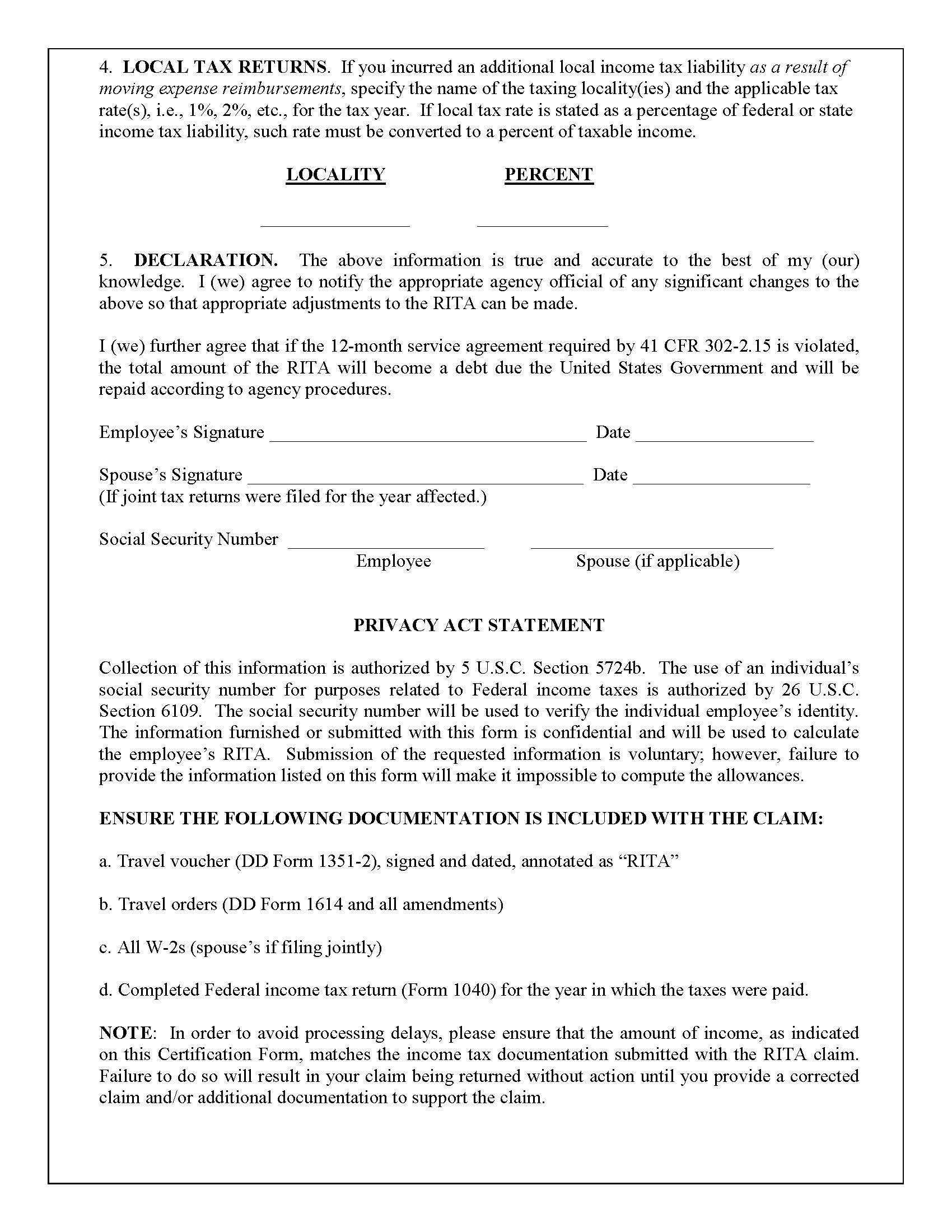

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Https Www Irs Gov Pub Irs News Fs 08 12 Pdf

Your Bullsh T Free Guide To Taxes In Germany

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Missing Stimulus Payment But Aren T Required To File Taxes Irs Says You Ll Have To File This Year To Get That Money Abc7 Chicago

Finance Tips For Writers Filing Taxes Tax Write Offs Tax Debt

Filing Taxes With Your Last Pay Stub H R Block

H R Block Review 2021 Pros And Cons

Us Citizens Living Abroad Do You Have To Pay Taxes

Tax Deadline May 17 2021 When To File Taxes

What Is The Penalty For Failure To File Taxes Nerdwallet

Your Bullsh T Free Guide To Taxes In Germany

Us Taxes For Expats American Citizens Living In Germany

Tax Deadline 2021 What Happens If You File Taxes Late As Com

Post a Comment for "How Do I File Taxes For Two States"