Free Tax Filing Schedule D

If you feel your paper didnt meet all your requirements we wont stop till its perfect. Gains from involuntary conversions other than from casualty or theft of capital assets not held for business or profit.

Schedule D Form 1040 Free Fillable Form Pdf Sample Formswift

The sale or exchange of a capital asset not reported on another form or schedule.

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

Free tax filing schedule d. 14 Zeilen A simple tax return excludes self-employment income Schedule C capital gains and losses Schedule D rental and royalty income Schedule E farm income Schedule F shareholderpartnership income or loss Schedule K-1 and earned income credit Schedule EIC. Find out if you have a simple return and more about what this years Free Edition includes. Use Schedule D Form 1040 to report the following.

Not everyone has a simple return. 0 Federal 0 State 0 To File offer is available for simple tax returns with TurboTax Free Edition. A simple tax return is Form 1040 only without any additional schedules OR Form 1040 Unemployment Income.

Form 1040 Schedule A itemized deductions Schedule B interest and dividend income Schedule C small business schedule D. Tax forms supported with free version. She is 42 years old and has been divorced for five years.

When filling in Schedule-D it asks me to fill in stocks that I sold but again I did not sell any. For all other products you can start free and pay only when you file. Jenny Walters is a marketing assistant and earned 38000 in 2018.

The TaxAct Online Free Edition makes free federal filing available for simple returns only. Pennsylvania Schedule D must be filed separately by an individual and his or her spouse if the gains or losses were not generated on a joint basis. However recent legislation enacted in December 2019 restored the empowerment zone rollover for 2019 and retroactively extended it to 2018.

TurboTax Free Guarantee. When saving or printing a file be sure to use the functionality of Adobe Reader rather than your web browser. Once you download the Schedule D in your phone you can transfer it to your pc.

Schedule D is a tax form attached to Form 1040 that reports the gains or losses you realize from the sale of your capital assets. You file using the filing status of Single or Married Filing Jointly. Instructions for Schedule D Form 1040 Rollover of Gain from Empowerment Zone Assets is Available for 2018.

To be sure Americans who still need to file 2020 tax returns and are eligible for the IRS Free File program can continue to select Intuits software through October when the tax season ends. How would I overcome. Yes TaxSlayer Simply Free is really free if your tax situation meets the following requirements.

Im using Turbo Tax online for first time I need to fill in Schedule-D to get carryover loss of 3000 from previous years however for year 2020 I did not buy or sell any stock. Start Free and File Free. 31 Zeilen Schedule D.

Your taxable income is less than 100000. You claim no dependents. Capital Gains and Losses.

The ability to roll over gain from empowerment zone assets expired at the end of 2017. TaxAct provides free filing to people with W-2 income education expenses but not student loan interest and people who want to claim the child tax. 2020 Federal Tax Forms And Instructions for Schedule D We recommend using the most recent version of Adobe Reader -- available free from Adobes website.

Tax Filing Schedule D and Form 8949. Filing Form 1040 Schedule D Proceeds from the sale of real estate personal property and investments are the types of gains typically reported to the IRS as income on Schedule D. State programs can be added within the program for an additional cost.

Completing Form 1040 With A Us Expat 1040 Example

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

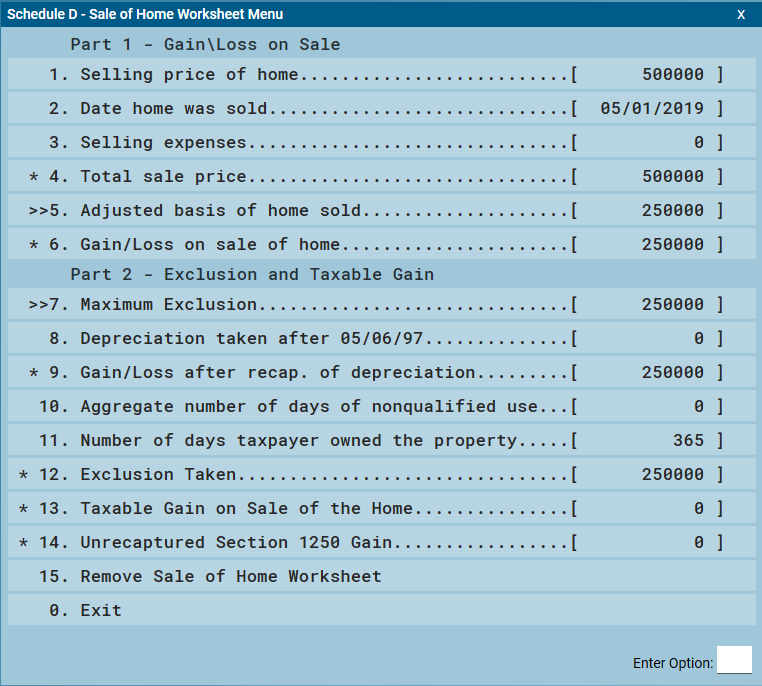

Excluding The Sale Of Main Home Support

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Https Communications Fidelity Com Sps Library Docs Bro Tax Sop Nq Click Pdf

Form 8949 Instructions Information On Capital Gains Losses Form

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

What Is Schedule D Here Is An Overview Of The Schedule

Irs Schedule D Form 8949 Guide For Active Traders

What Is Schedule D Here Is An Overview Of The Schedule

Completing Form 1040 With A Us Expat 1040 Example

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Https Www Irs Gov Pub Irs Pdf I1041sd Pdf

How To Report Cryptocurrency On Taxes Tokentax

Free Tax Assistance Available For Low Income And Other Qualified Taxpayers

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)

/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)

Post a Comment for "Free Tax Filing Schedule D"